It's become harder and harder to keep track of all the new AI advances lately. One day, you're amazed at its ability to create unique art, the next day you hear about ChatGPT, and now you're worried it will take your job.

The truth is AI advancements are simply astonishing. However, it doesn't necessarily mean it's after your job. But one thing remains obvious: we will all need to adapt and learn how to interact and work with AI to stay on top of the competition and, simply, stay relevant.

In this article, we will delve into the topic of GPT-3 and learn the following information:

- What is GPT-3?

- GPT-3 latest numbers and statistics

- GPT-3 main use cases in the financial sector

- Platforms that currently run on GPT-3 and their benefits

What Is GPT-3

GPT-3 (Generative Pre-trained Transformer 3) is a state-of-the-art language model developed by OpenAI. The GPT-3 model has the ability to generate text based on the user’s intent in a human-like manner with high accuracy.

GPT-3 now has a wide range of applications. With its ability to analyze large amounts of data and identify patterns and trends, GPT-3 is being used to improve customer service, risk management, fraud detection, and underwriting in the financial services industry.

What are Language Models (LMs)?

A language model is a complex term for us, mere mortals. To put it in simple terms, language models are computer programs that can understand and generate human language. They are trained on large amounts of text data and can predict what word or phrase is likely to come next in a sentence. They are used in a variety of applications such as speech recognition, machine translation and text generation.

GPT-3 Latest Numbers and Statistics

One of the most striking features of GPT-3 is that it’s one of the largest language models available, with 175 billion parameters, which is 10 times larger than any previous model.

Generally speaking, models with more parameters require more data to be trained. According to its creators at OpenAI, the GPT-3 model has been trained using 45 terabytes of text data from various sources such as Wikipedia and books.

Another overwhelming fact about GPT-3 is its accuracy in language tasks. In a study conducted by OpenAI, GPT-3 achieved a score of 86.9 on the SuperGLUE benchmark, which measures a model's ability to perform a wide range of language understanding tasks. This score is significantly higher than that of any other model that has been tested on the SuperGLUE benchmark, making GPT-3 the most accurate language model currently available.

In a study by OpenAI, GPT-3 generated text that was indistinguishable from text written by humans in many cases. This is a significant achievement, as it demonstrates GPT-3's ability to generate text that is not only accurate but also natural and easy to read.

Another notable fact about GPT-3 is its ability to generate text on a wide range of topics. It has been trained on a diverse range of internet text, allowing it to generate text on a multitude of topics with high accuracy. This makes it a valuable tool for many different applications, from customer service to content creation.

All this serves as a confirmation that AI will rule the future of business and technological development. Not only will it impact the way we work and interact with clients, but it will also transform the industries themselves.

Let's explore how AI will impact the financial services industry.

Main Use Cases of GPT technology in Banking and Insurance

Automation

Automating responses for customer inquiries, allowing banks and insurance companies to handle a large volume of customer interactions with high accuracy and efficiency, creating client consultation summaries, – these are a few use cases that make GPT-3 technology so valuable in the financial sector that employs lots of customer-facing teams.

Not only can client advisors and RMs leverage state-of-the-art technology to enhance their interactions with clients, but they also become much more efficient by saving at least 10 minutes of manual work with every client. No more manual CRM updates. With the right tools equipped with the latest AI technologies, client advisors can focus on what really matters - client relationships.

Risk Management

Another area where GPT-3 is being used in the financial sector is risk management. GPT-3 can be trained to analyze large amounts of data and identify patterns and trends that may indicate potential risks. This can help banks and insurance companies to better understand and manage their risk exposure, leading to more accurate pricing and underwriting of policies.

Fraud Detection

GPT-3 is also being used for fraud detection. It can be trained to detect suspicious activity and flag any potential fraudulent activity for further investigation. This can help prevent money laundering and other potentially harming activities that can cost banks and insurances their profits.

Customer Service

However, one of the most prominent features of GPT-3 is how it improves and supercharges client advisors and RM to provide an upgraded customer experience. By using GPT-3 to generate personalized and tailored responses to customer inquiries, banks and insurance companies can provide more efficient customer service, which can lead to improved customer satisfaction and loyalty.

Unique: Supercharging Client-Facing Teams with AI-powered technology

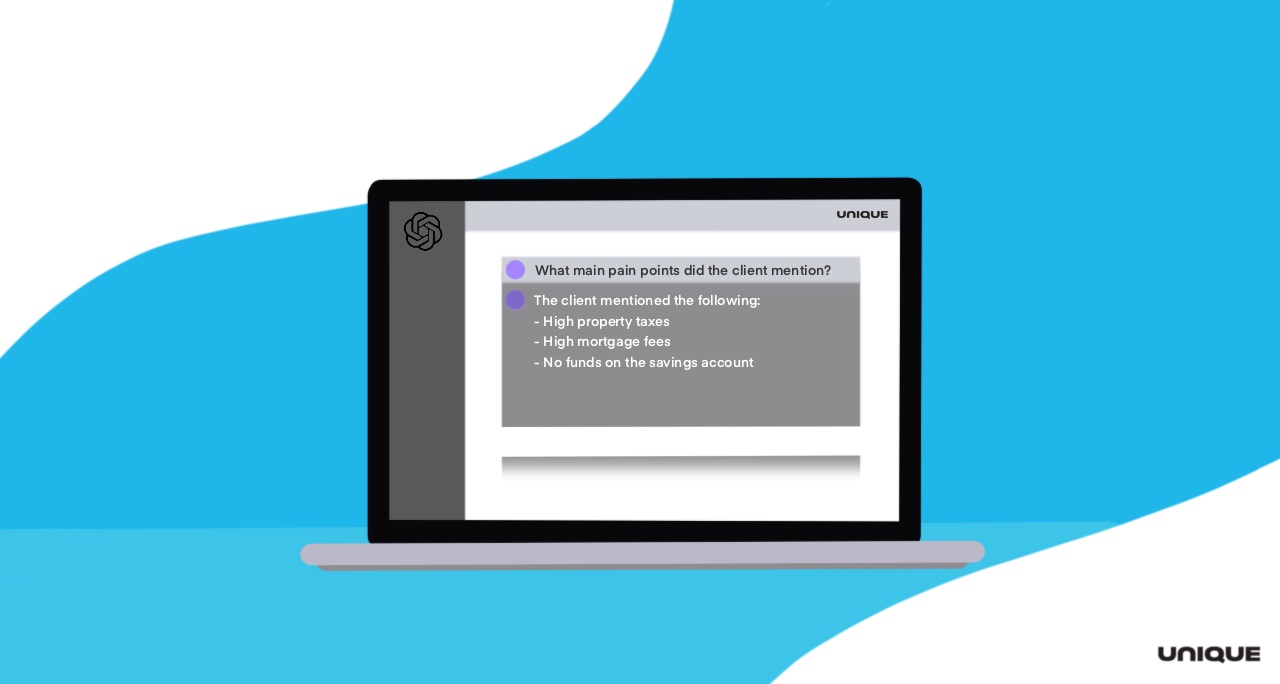

Unique is a provider of advanced client intelligence solutions for the financial services industry. Utilizing the cutting-edge GPT technology from Azure OpenAI Service, Unique automates tedious manual documentation, offers live support to client advisors, and examines customer interactions to uncover cross-selling and upselling opportunities.

Additionally, with the use of OpenAI's Whisper for speech recognition, Unique records and examines conversations through various communication channels such as Microsoft Teams, Zoom, Google Meets, phone calls, and offline meetings. With OpenAI's GPT-3.5 and ChatGPT, client advisors can swiftly create real-time reports and summaries to better comprehend their clients' needs.

GPT-3 Is Here To Transform The Banking and Insurance Industry

In conclusion, GPT-3 has the potential to revolutionize the way that banks and insurance companies operate. With its ability to generate human-like text with high accuracy and its ability to analyze large amounts of data and identify patterns and trends, GPT-3 can be used for a wide range of applications, including customer service, risk management, fraud detection, and underwriting. As the technology continues to evolve and improve, we can expect to see even more uses for GPT-3 in the banking and insurance industry in the future.