The financial industry is undergoing rapid transformation and has started embracing AI platforms and tools to streamline and automate operations.

By doing quick research, you can find a large number of AI-driven solutions for any problem you've got. Be it automation, fraud prevention, entity recognition, analysis of internal data, you name it -- the SaaS market's got you covered. However, wouldn't it be just amazing to have one platform that is specifically tailored to solve your industry-specific problems in the blink of an eye?

One technology that is behind all these capabilities is the Generative Pre-trained Transformer (GPT), a language model that generates human-like text.

As GPT is a largely customizable technology, the financial industry didn't have to wait long to see the creation of a tailored solution that caters to its specific needs - FinanceGPT.

In this article, we will delve deeper into a specialized generative AI platform designed for the financial sector called Unique FinanceGPT and explore its advantages for the industry.

What is GPT?

GPT is a cutting-edge artificial intelligence language model introduced by OpenAI. It utilizes a wide range of sophisticated deep learning techniques to generate human-like text. Essentially, it is a pre-trained neural network that can be fine-tuned for specific tasks, such as content creation, translation, and information search. GPT models can be trained on vast amounts of text data, making them capable of producing coherent and grammatically correct text that has many types of applications.

What is FinanceGPT?

FinanceGPT is a special term describing a generative AI platform specially designed for the finance sector. It uses GPT technology to automate a variety of tasks and reduce manual workload, thus, enhancing productivity.

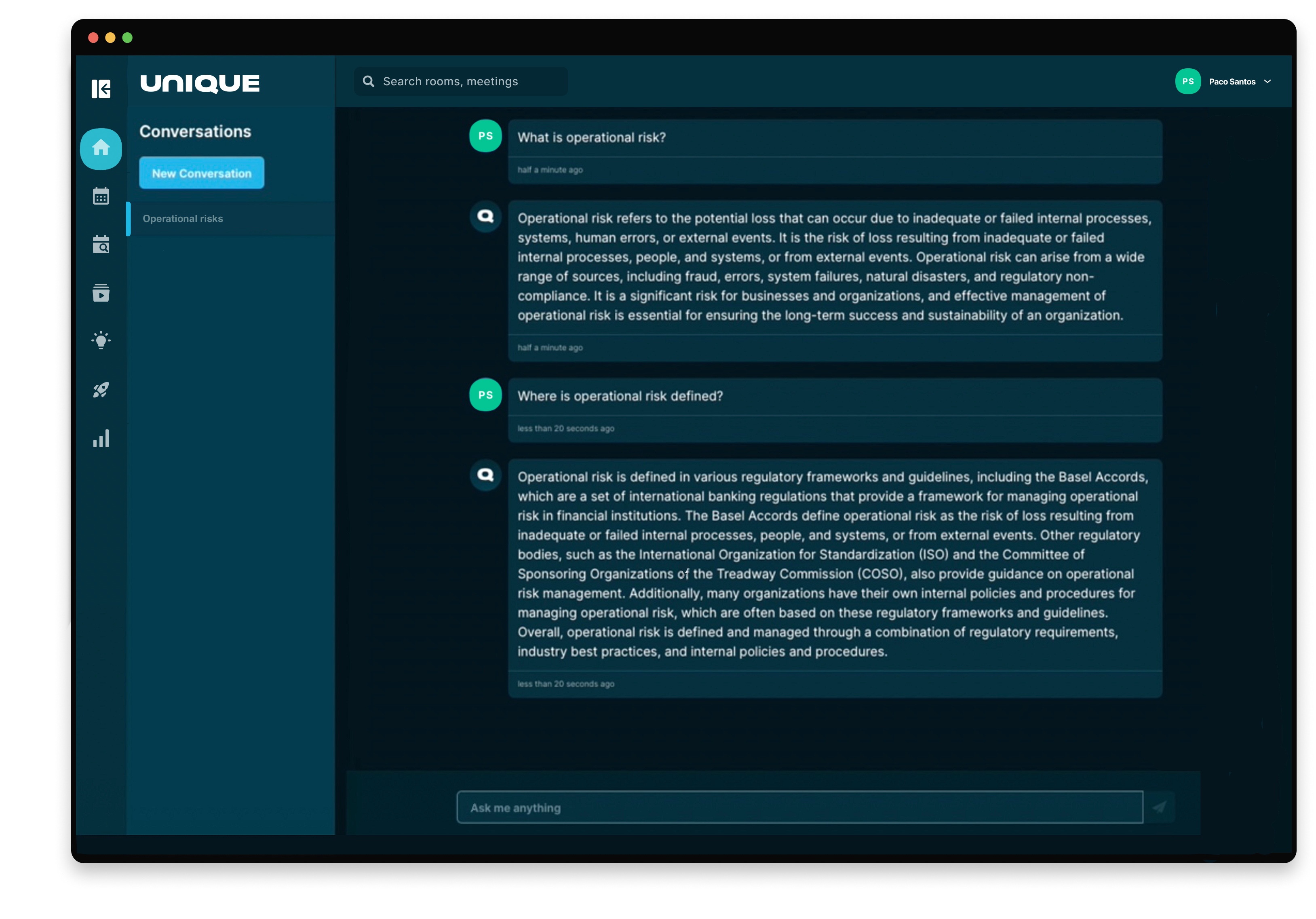

The platform allows relationship managers and client advisors to access internal data via a chat-like interface, enabling users to prompt for specific requests. The platform is designed to be flexible and customizable, catering to the specific needs of every individual organization.

Benefits of FinanceGPT for the financial industry

There are numerous benefits of using FinanceGPT in the financial industry. The most prominent use cases include:

- Reduced manual workload.

- The possibility to focus on high-value tasks such as building client relationships.

- Increased accuracy and efficiency due to automating repetitive tasks.

- Faster decision-making thanks to quick access to pertinent information.

The vast majority of RMs and advisors spend too much time on non-revenue generating tasks such as manual CRM entries and filling out documentation. With the FinanceGPT solution at hand, they can reduce the workload and save enough time to focus on building long-lasting relationships with clients.

What is Unique FinanceGPT and How It Works

Unique FinanceGPT is a platform tailored to banking and insurance industries that runs on state-of-the-art OpenAI's GPT-3 language model and has a long term memory that you can "chat" with. The platform is intended to increase productivity by automating manual workload through AI and ChatGPT solutions. It can be customized to meet the unique needs of each financial institution. Unique FinanceGPT connects to data sources such as regulatory documents, client-specific information, call recordings, etc., in a secure and compliant manner.

Unique FinanceGPT works by utilizing natural language processing to understand user requests and generate relevant responses. It can answer questions, do calculations, generate reports, and perform a multitude of other tasks. What's more Unique FinanceGPT also has built-in security features to safeguard sensitive financial data.

One of the unique features of Unique FinanceGPT is its ability to integrate with existing systems and data sources, providing a seamless user experience. It can also be customized to meet the specific regulatory compliance and risk management needs of each financial institution.

All you need to do is give Unique Chat a prompt, for example: "Generate a list of requirements to ask for when opening a new corporate client account?" The AI will then access your uploaded documents, and generate a precise answer personalized to you company and industry.

In addition to these functionalities, the Unique artificial intelligence platform can be used to facilitate coaching and help banking and insurance professionals deliver better customer service. Not only will they be able to access any regulatory information at any time, but they will also receive additional functionalities like call recordings, call analytics, a sidebar agenda to follow on a call and an extensive library of training videos and best practices, from which they can learn on a daily basis.

Security & Compliance With Unique FinanceGPT

We all know that banking and insurance are heavily regulated industries. That's why there might be concerns pertaining to compliance and security when using Unique FinanceGPT. However, when it comes to GDPR compliance and security, Unique deploys all possible measures to protect customer data and stay up-to-date with regulations:

- Unique is a Microsoft partner and all customer data is stored on Microsoft Azure Cloud in Switzerland.

- Unique's servers are located within Unique’s own private cloud, and its APIs are managed carefully to not allow any untrusted external connections.

- OpenAI access is secure via Microsoft Europe and an opt-out option for training purposes and prompt checking is available.

- Unique received ISO 27001 and ISO 9001 certification.

- Unique’s GDPR-compliant process flow guarantees consent from all meeting attendees.

- Data access and authorizations are managed on a need-to-know basis, and we apply the principle of least privilege.

- Any data and connections with Unique are secure using the latest encryption standards.

Unique FinanceGPT is the best AI Platform to Supercharge your Client-Facing Team

The use of AI tools and platforms such as Unique FinanceGPT can significantly benefit the finance industry as they reduce manual workload, improve accuracy and efficiency, and enable faster decision-making. In today's rapidly evolving market, it is critical for financial institutions to remain competitive and embrace innovative technologies. Unique FinanceGPT provides a tailored solution for the finance industry that is secure, efficient, and customizable, enhancing the industry's overall productivity and competitiveness.