Unique conducted Annual Unique Banking Survey to examine the administrative responsibilities of client-facing banking roles. The survey's goal was to understand these tasks in depth to find innovative applications for Unique's FinanceGPT technology to reduce administrative workload and increase customer satisfaction.

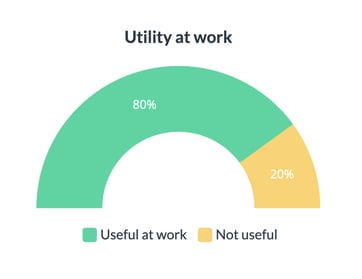

A significant insight is the acknowledgment by 80% of respondents that ChatGPT could aid daily work tasks, suggesting a broad range of applications from email automation to enhancing efficiency.

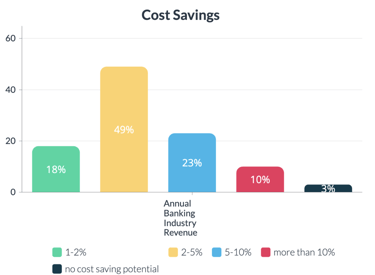

Despite this, a notable gap exists in AI training and guidelines, with banks lacking in this area. This indicates a substantial opportunity for banks to invest in AI education and implementation to not only enhance operational efficiency but also to potentially realize cost savings, estimated at 2-5% of annual costs by nearly half of the respondents.

Moreover, a reduction in administrative tasks could lead to improved client relationships and increased revenue, underscoring the strategic importance of AI technology in banking’s future.

Survey Findings

General Use of ChatGPT

1. Previous Experience with ChatGPT:

44% of participants have used ChatGPT for business, 55% for private matters, and only 1.6% have not used it.

2. Utility in Daily Work:

80% believe ChatGPT would aid in daily work.

3. Application in Daily Work:

ChatGPT's potential uses included rewriting or summarizing texts, time-saving in topic input, reducing time for customer letter creation, etc.

ChatGPT in the Workplace

4. Accessibility at Work:

Responses are nearly split on whether employers have blocked ChatGPT, with a slight majority (52.5%) indicating it is not blocked

5. Introduction of GPT Technologies:

Responses showed that most employers don’t offer GPT technologies internally, however some are planning it in the future.

6. Departments Driving AI:

Innovation-focused roles and IT development are the key drivers of AI initiatives, as indicated by the responses.

AI Initiatives and Investment

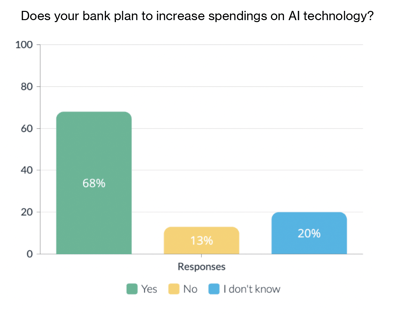

7. AI Spending:

68% of the respondents expect increased spending on AI technology in their banks.

Competitiveness and Interaction with Clients

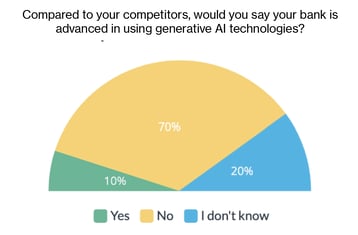

8. Comparative Advancement in AI:

A majority, 70%, perceive their banks as not advanced in using generative AI technologies when compared to competitors.

9. Client Interaction:

The most common interaction methods with clients are on-site meetings (92.5%), emails (92.5%) calls (80%), and video calls (70%).

Data Management and Compliance

10. CRM Data Quality:

The quality of data in CRM systems varied, with 7.5% rating it very good, 45% sufficient, and 42.5% suggesting it needs improvement.

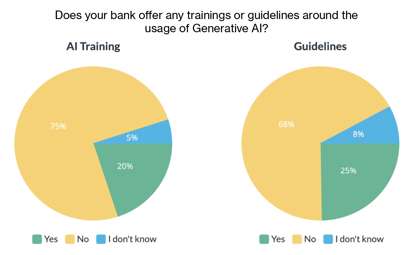

11. AI Training & Guidelines:

Most banks do not offer training on generative AI (75%) nor do they have guidelines on how to interact with such AI (67,5%).

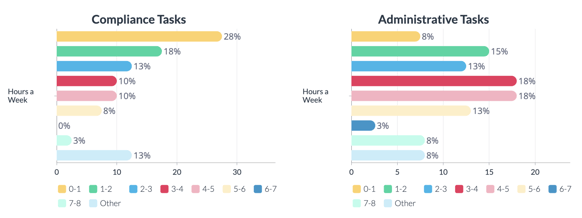

12. Compliance and Administrative Tasks:

Compliance-related tasks take up 0-2 hours weekly for 46% of respondents and 48% report spending 2 hours and more (up to 8+ hours) on compliance tasks a week.

Time spent on administrative tasks varies, with 4 hours being a median number.

13. Time-consuming Tasks

Documentation and reporting are the most time-consuming administrative tasks, as indicated by 55% of respondents.

Automation and Efficiency

14. Potential for Automation:

Generative AI is seen as having considerable potential to automate tasks like research, email management and documentation.

15. Admin Task Reduction Impact:

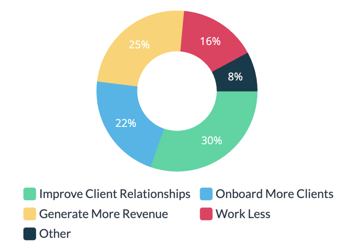

A reduction of 30-50% in administrative tasks could lead to improved client relationships (30%), more client onboarding (22%), and increased revenue generation (25%).

Perception of Generative AI

16. Efficiency Gains:

Most respondents estimate a modest efficiency gain through ChatGPT, with the largest group (62.5%) expecting 0-19% improvement.

17. Areas of Potential:

Market research, customer service, and compliance are identified as the areas with the greatest potential for Generative AI applications.

Cost Savings and Client Services

18. Cost Savings:

Cost savings due to Generative AI are estimated to be between 2-5% of annual banking industry costs by 49% of respondents.

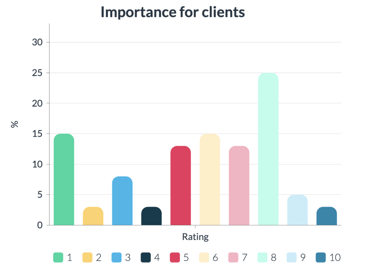

19. Importance of AI-Powered Services:

The importance of offering AI-powered banking services received an average rating of 5.63 out of 10.

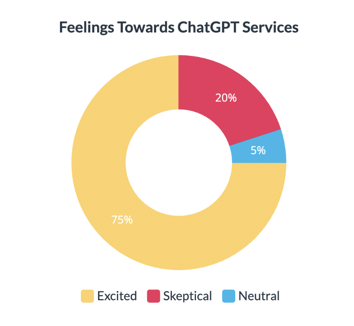

20. Feelings Towards ChatGPT:

Excitement about AI's potential is the predominant sentiment, with 75% feeling excited, 20% skeptical, and 5% neutral.

Conclusion

The survey indicates a banking sector that is both eager and cautious about AI integration. There is a clear recognition of AI's potential to streamline operations and a desire to embrace new technologies. However, there is also an understanding that careful implementation is key to realizing these benefits. These insights will guide Unique in refining FinanceGPT to meet the specific needs of the banking industry, ultimately enhancing the effectiveness of client-facing roles.